Cooperation:

2+ yrs.

Cooperation:

2+ yrs.

Code refactoring unlocked cloud freedom for the energy sector

Cloud freedom unlocked. We refactored energy software to migrate 4x faster across Azure, AWS, and on-prem — with zero vendor lock-in and 75% lower costs. NetLS makes it possible.

Cooperation:

1+ yr.

Cooperation:

1+ yr.

How test automation enabled faster releases and better quality for a telecom client

In this case study, you'll discover how we helped our long-time client from Europe develops BSS (Business Support System) solutions for communications service providers. We helped it modernize testing for its ERP product — automating complex UI and mobile workflows using a CI/CD-driven framework with Reqnroll, BDD, and Azure DevOps.

Cooperation:

1+ yr.

Cooperation:

1+ yr.

IoT data pipeline for an energy company on the Azure Cloud

To effectively help businesses optimize energy consumption, our client needed an internal system for displaying and processing IoT data for whether a block of flats or a building or a factory for better analytics, automated reporting, visualization, and actionable recommendations. Our extensive and profound technical expertise in designing innovative solutions enabled us to start working on this complex project with confidence.

Cooperation:

2+ yrs.

Cooperation:

2+ yrs.

ACH payment processing system for a financial platform

We implemented a solution that supports ACH payments through the NACHA file communication protocol with a distinct logic of money distribution between the client, brokers, and syndicates.

Cooperation:

8+ mos.

Cooperation:

8+ mos.

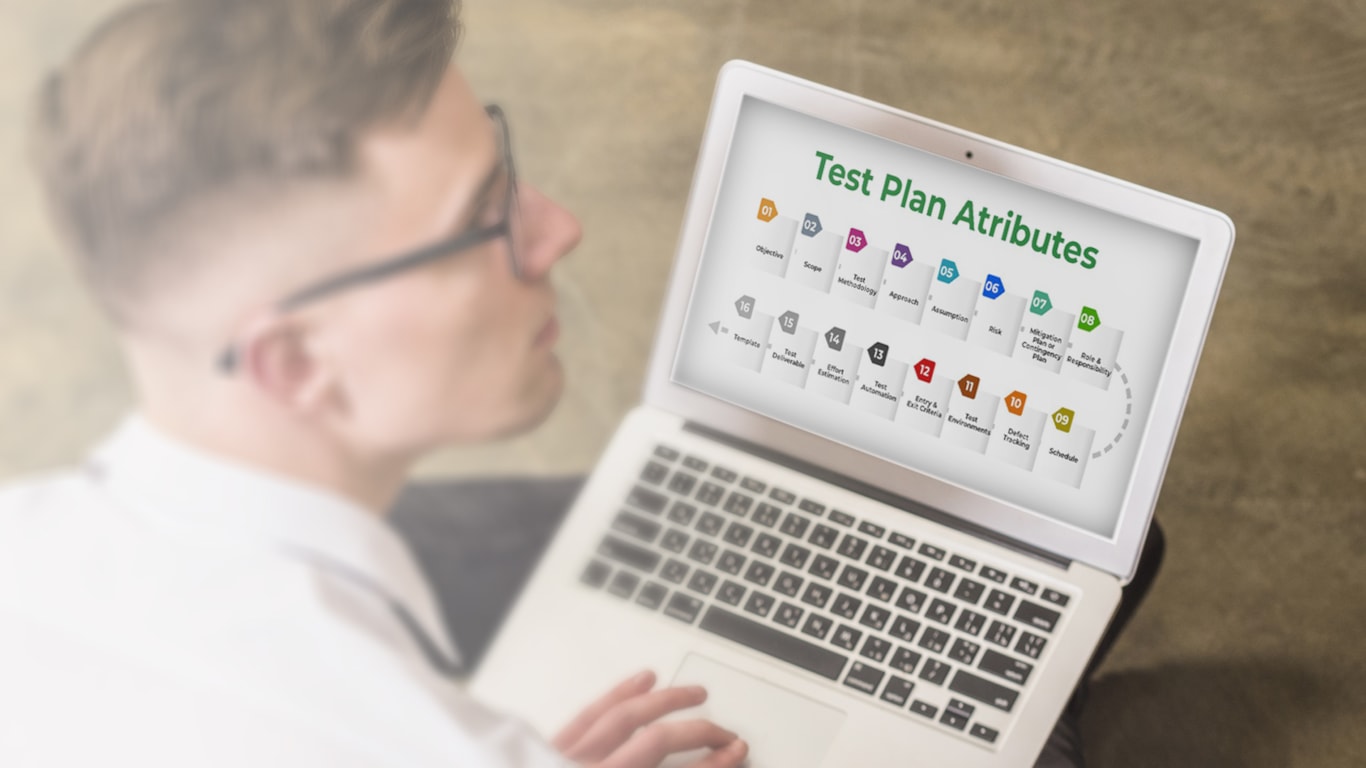

Preparing a test plan for a billing system in the telecom industry

In this case, the client needed to meet the rigorous needs of one of the largest mobile operators and internet providers in Ukraine (NDA). With a workforce of around 4,000 employees and over 27 million users nationwide, the project required careful planning at every implementation stage. To ensure superior development quality and product stability, the NetLS team designed a step-by-step test plan to coordinate testing efforts, reduce risks, and improve overall process efficiency.

Cooperation:

1+ yr.

Cooperation:

1+ yr.

Automated auditing solution for a family investment fund

Our client, a French family investment fund, offers loans and B2B2X fintech services, including business and call centers. As it expands into a new EU market through a child company, it’s transitioning from a legacy system to a proprietary solution. The main challenge was the absence of a unified financial data system, leading to reporting inconsistencies and security concerns. To validate the market, the client needed a fast, cost-effective PoC for automated payment matching and audit readiness.

Cooperation:

1+ mo.

Cooperation:

1+ mo.

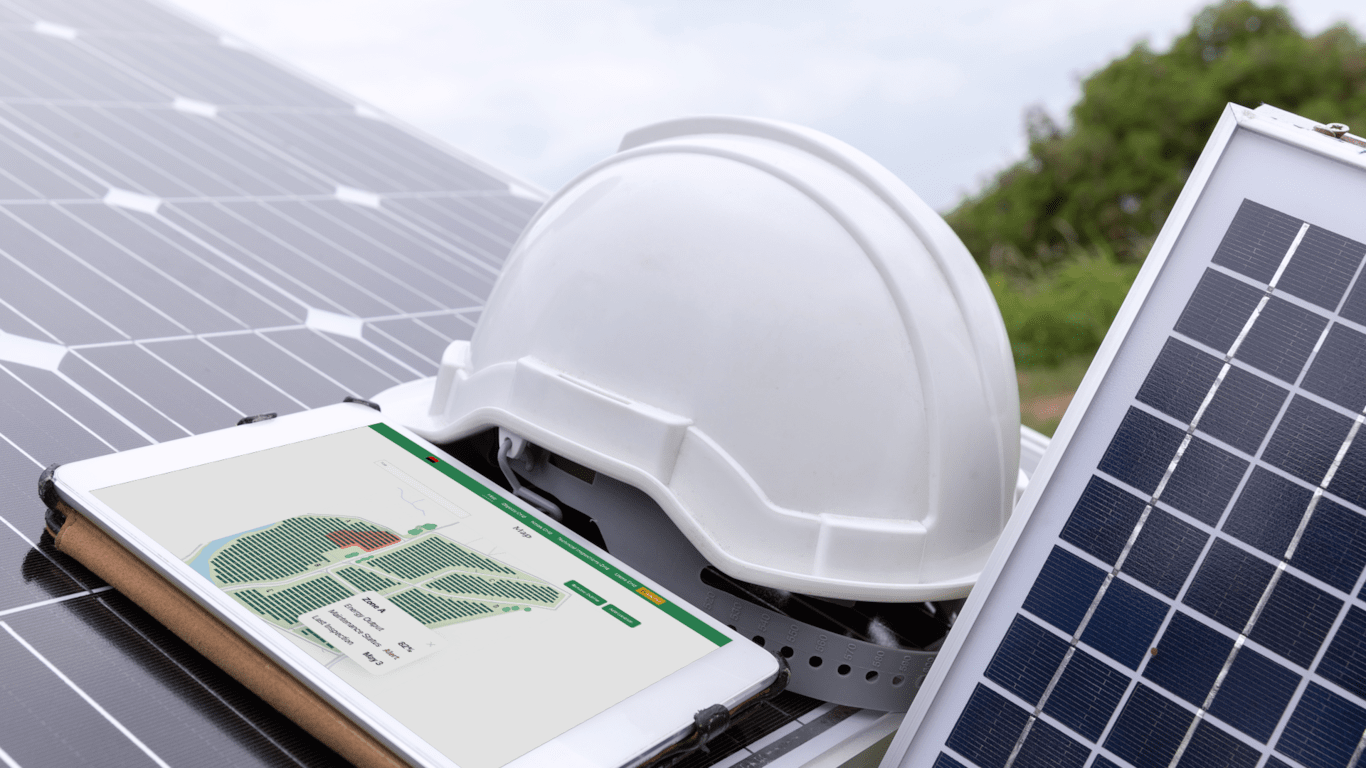

Online map-based reporting solution for the energy sector

Our client, a company in the energy sector, owns several power plant panels on different sites and is actively expanding its facilities. The key requirement was a solution that could quickly display the status of each power plant on the interactive map. Our team immediately jumped into the process and began building the solution from scratch.

Cooperation:

1+ mo.

Cooperation:

1+ mo.

Development of an effective ETL solution for efficient business management

Our client in the public sector, telecommunications domain, faced challenges in processing and analyzing large volumes of data from Telegram chats. They required a targeted search based on specific locations, keywords, and issues related to utility services. We suggested an efficient ETL solution for extracting meaningful insights from vast amounts of data across multiple chats.

Cooperation:

1+ mo.

Cooperation:

1+ mo.

Growing of .NET specialists from scratch

Get a productive and qualified team of developers that is the cheapest on the market. After training, Software Full-Stack Engineers are ready to work on projects for our customers

Cooperation:

2+ yrs.

Cooperation:

2+ yrs.

Implementation Of AI/ML Scoring System in FinTech

NetLS developers managed to reduce the default rate in our client's financial company. Automated underwriting, based on AI/ML and automation technologies, has become an opportunity to simplify, reduce the cost and speed up the process of processing loan applications.

Cooperation:

5+ yrs.

Cooperation:

5+ yrs.

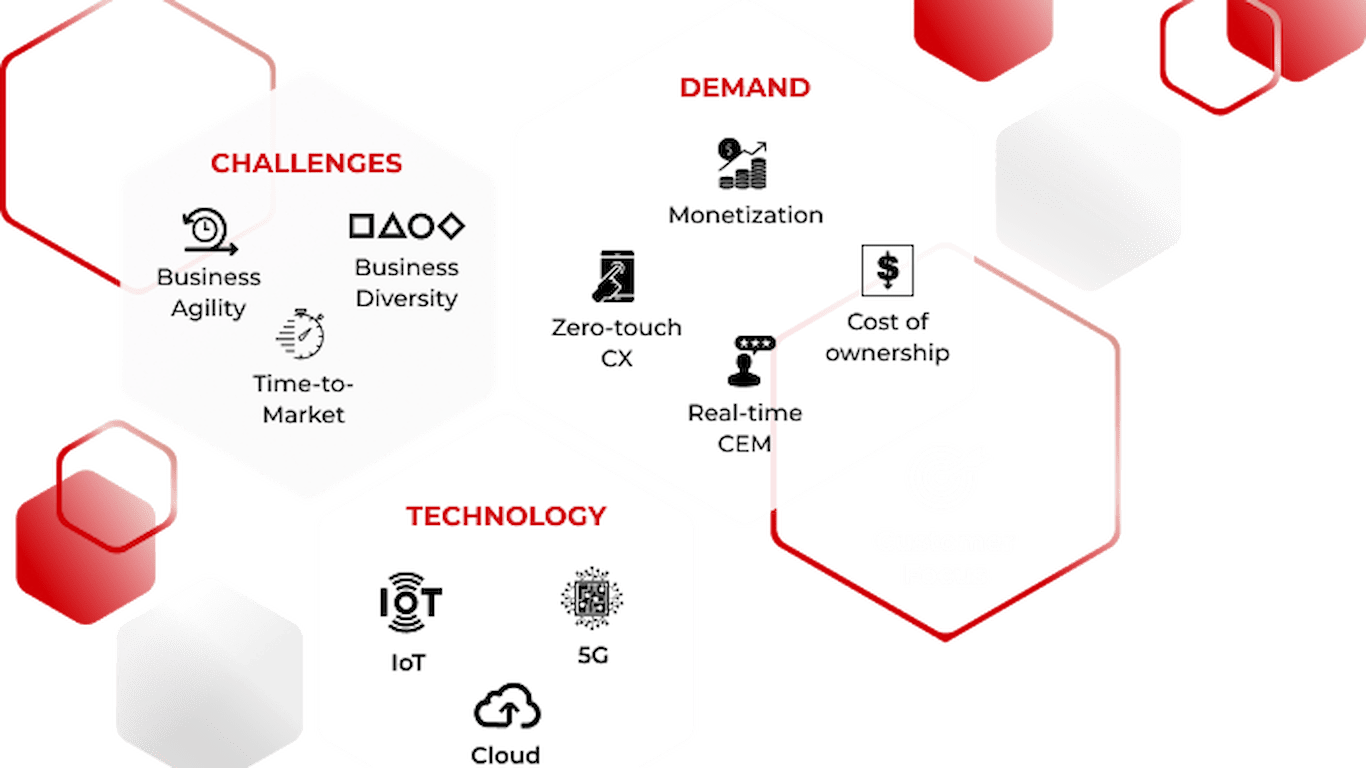

Modern billing solutions, updating the outdated system and entering new markets for NATEC

NATEC develops modern billing solutions for communication service providers. Our team helped to adapt the WideCoup BSS product to the needs of their client, one of the largest mobile operators and Internet providers in Ukraine

Cooperation:

2+ mos.

Cooperation:

2+ mos.

We speed up our client's software development life cycle by 40%

Natek R&D implements the latest solutions in the telecommunications industry and has more than 100 companies. Their BSS software and continuous platform MEF.DEV, developed by our team, accelerate the development and management of the application