Cooperation:

1+ yr.

Cooperation:

1+ yr.

IoT data pipeline for an energy company on the Azure Cloud

To effectively help businesses optimize energy consumption, our client needed an internal system for displaying and processing IoT data for whether a block of flats or a building or a factory for better analytics, automated reporting, visualization, and actionable recommendations. Our extensive and profound technical expertise in designing innovative solutions enabled us to start working on this complex project with confidence.

Cooperation:

1+ yr.

Cooperation:

1+ yr.

Automated auditing solution for a family investment fund

Our client, a French family investment fund, offers loans and B2B2X fintech services, including business and call centers. As it expands into a new EU market through a child company, it’s transitioning from a legacy system to a proprietary solution. The main challenge was the absence of a unified financial data system, leading to reporting inconsistencies and security concerns. To validate the market, the client needed a fast, cost-effective PoC for automated payment matching and audit readiness.

Cooperation:

1+ yr.

Cooperation:

1+ yr.

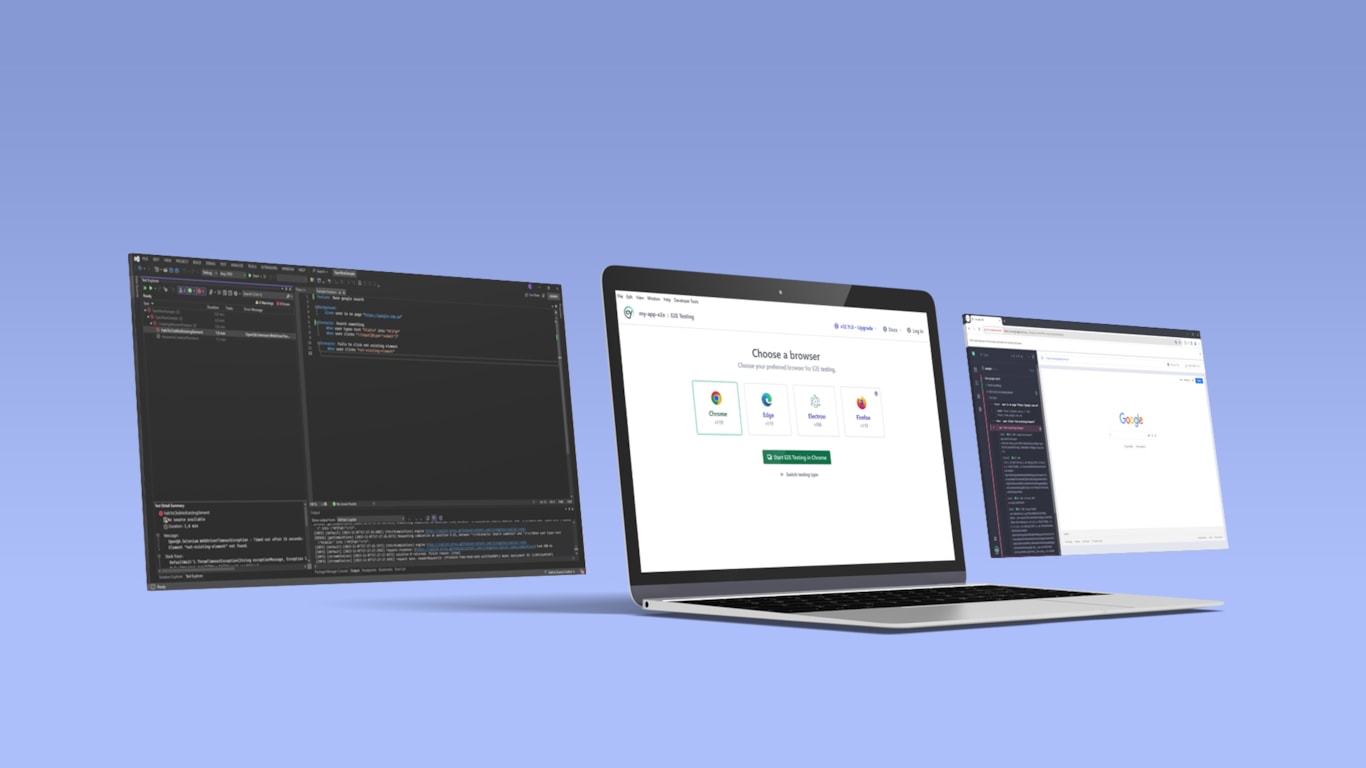

Optimized processes by improving the level of testing automation

We simplified the automated testing process by allowing testers to use Gherkin syntax. As a result, automated testing has become almost independent of engineer intervention, and budget costs have decreased by 30%

Cooperation:

2+ yrs.

Cooperation:

2+ yrs.

Implementation Of AI/ML Scoring System in FinTech

NetLS developers managed to reduce the default rate in our client's financial company. Automated underwriting, based on AI/ML and automation technologies, has become an opportunity to simplify, reduce the cost and speed up the process of processing loan applications.