Cooperation:

2+ yrs.

Cooperation:

2+ yrs.

Code refactoring unlocked cloud freedom for the energy sector

Cloud freedom unlocked. We refactored energy software to migrate 4x faster across Azure, AWS, and on-prem — with zero vendor lock-in and 75% lower costs. NetLS makes it possible.

Cooperation:

1+ yr.

Cooperation:

1+ yr.

IoT data pipeline for an energy company on the Azure Cloud

To effectively help businesses optimize energy consumption, our client needed an internal system for displaying and processing IoT data for whether a block of flats or a building or a factory for better analytics, automated reporting, visualization, and actionable recommendations. Our extensive and profound technical expertise in designing innovative solutions enabled us to start working on this complex project with confidence.

Cooperation:

1+ yr.

Cooperation:

1+ yr.

Automated auditing solution for a family investment fund

Our client, a French family investment fund, offers loans and B2B2X fintech services, including business and call centers. As it expands into a new EU market through a child company, it’s transitioning from a legacy system to a proprietary solution. The main challenge was the absence of a unified financial data system, leading to reporting inconsistencies and security concerns. To validate the market, the client needed a fast, cost-effective PoC for automated payment matching and audit readiness.

Cooperation:

1+ mo.

Cooperation:

1+ mo.

Online map-based reporting solution for the energy sector

Our client, a company in the energy sector, owns several power plant panels on different sites and is actively expanding its facilities. The key requirement was a solution that could quickly display the status of each power plant on the interactive map. Our team immediately jumped into the process and began building the solution from scratch.

Cooperation:

1+ mo.

Cooperation:

1+ mo.

Development of an effective ETL solution for efficient business management

Our client in the public sector, telecommunications domain, faced challenges in processing and analyzing large volumes of data from Telegram chats. They required a targeted search based on specific locations, keywords, and issues related to utility services. We suggested an efficient ETL solution for extracting meaningful insights from vast amounts of data across multiple chats.

Cooperation:

6+ yrs.

Cooperation:

6+ yrs.

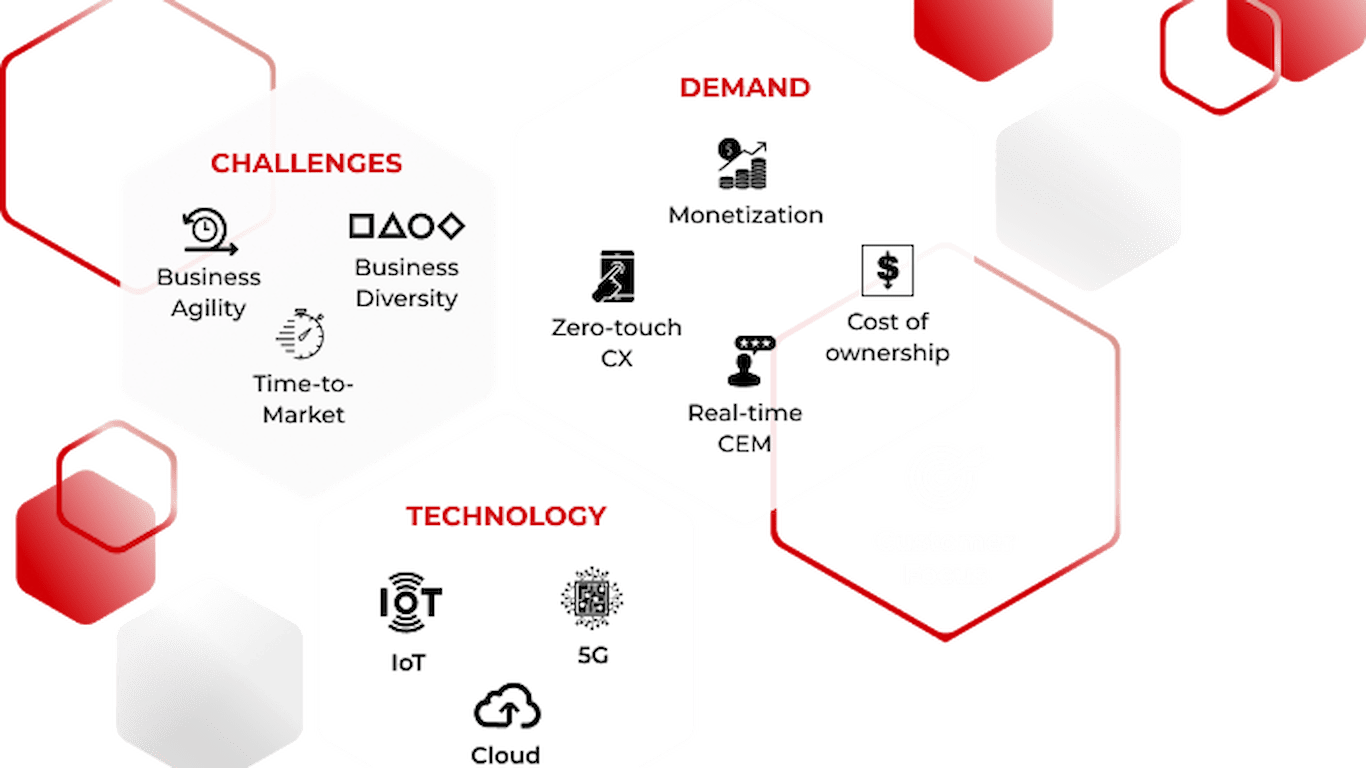

Modern billing solutions, updating the outdated system and entering new markets for NATEC

NATEC develops modern billing solutions for communication service providers. Our team helped to adapt the WideCoup BSS product to the needs of their client, one of the largest mobile operators and Internet providers in Ukraine

Cooperation:

2+ mos.

Cooperation:

2+ mos.

We speed up our client's software development life cycle by 40%

Natek R&D implements the latest solutions in the telecommunications industry and has more than 100 companies. Their BSS software and continuous platform MEF.DEV, developed by our team, accelerate the development and management of the application