Risk-free enterprise architecture: TOGAF and ArchiMate for strategic growth

For large organizations, it is especially important that business processes are coordinated, structured, and well-integrated with the IT infrastructure. TOGAF and ArchiMate are powerful tools that help professionals streamline all processes and create a forward-looking enterprise architecture.

BPMN 2.0: How BPMN standards help build modern architectures

Legacy systems holding you back? Disconnected tools and outdated processes lead to costly errors and slow growth. BPMN 2.0 brings clarity. New version helps align business, teams, and stakeholders through visual process models that drive smarter cloud migration and faster transformation.

Process-driven automation for businesses: How BPMN, RPA, and ETL work together

Still stuck with manual workflows? Automation doesn’t have to mean massive rewrites or lost control. By combining clear process mapping (BPMN), no-code robotic automation (RPA), and smart data processing (ETL), you can streamline operations smoothly, integrating with your existing systems and scaling effortlessly in the cloud.

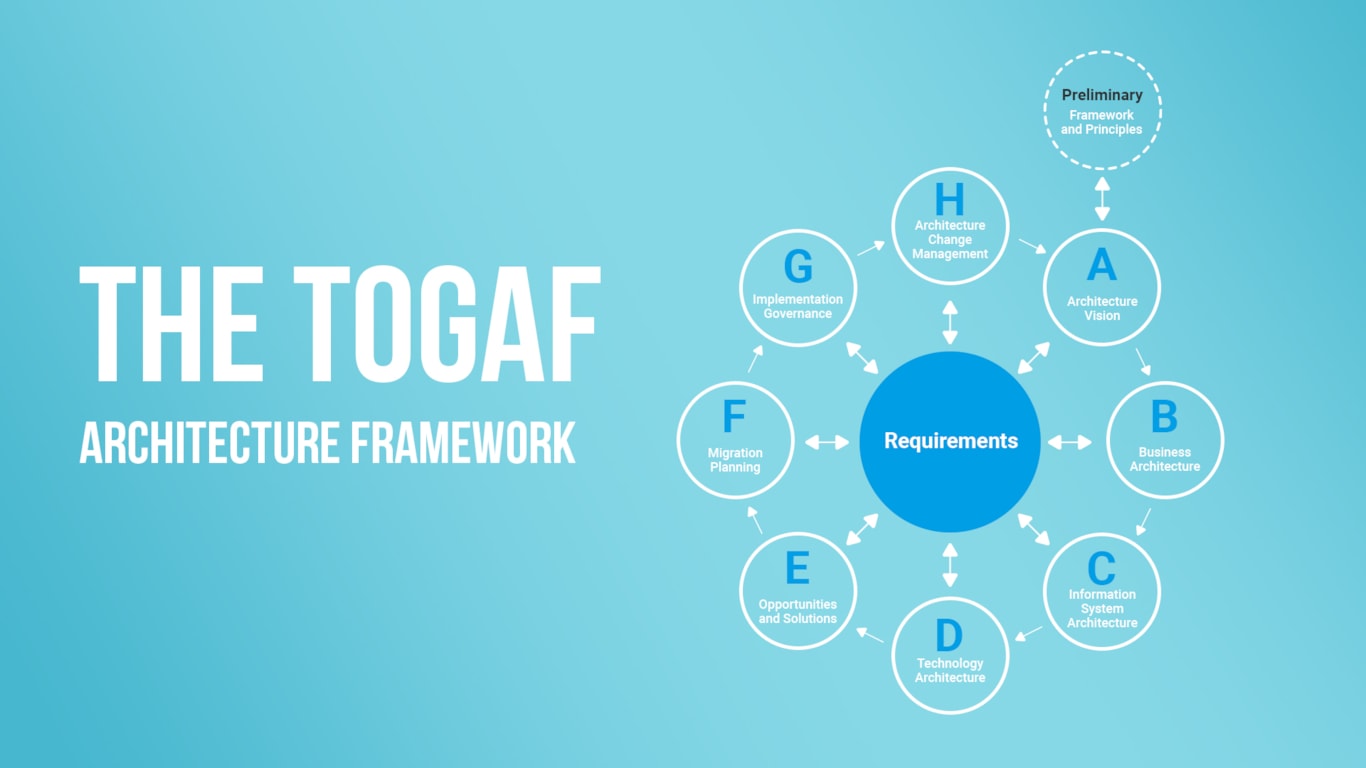

Using TOGAF and Archimate: Solving uncoordinated business processes

Uncoordinated business processes are the silent killers of enterprise efficiency. For large organizations, especially those with global operations, the challenge lies in aligning every team, system, and objective. Fortunately, frameworks like TOGAF and tools like ArchiMate offer a powerful path forward.

The process of preparing for enterprise architecture development with TOGAF

Modern businesses can’t afford to run on fragmented systems and outdated IT. To stay competitive, you need a unified architecture that connects strategy, processes, data, and technology. Start designing smarter. Explore how the right frameworks can turn architecture into your strategic advantage.

Why legacy architecture holds back business growth — and how to modernize it without risks

Outdated legacy systems slow innovation, increase costs, and create vendor lock-in risks. Learn how to unlock your business’s full potential with a step-by-step modernization roadmap designed to protect continuity and accelerate growth.

The importance of regulatory compliance integration when entering a new market in Fintech

Fintech thrives on innovation, advancing global financial services with modern technologies. The industry promises a lot of opportunities to ensure seamless payments all around the world. However, despite its immense potential, fintech companies, no matter the size, face a critical challenge: regulatory compliance. In this blog article, we’ll discuss regulatory compliance as a strategic asset for market entry and give tips from industry leaders for cross-border fintech compliance strategy.