Cooperation:

1+ yr.

Cooperation:

1+ yr.

Automated auditing solution for a family investment fund

Our client, a French family investment fund, offers loans and B2B2X fintech services, including business and call centers. As it expands into a new EU market through a child company, it’s transitioning from a legacy system to a proprietary solution. The main challenge was the absence of a unified financial data system, leading to reporting inconsistencies and security concerns. To validate the market, the client needed a fast, cost-effective PoC for automated payment matching and audit readiness.

Cooperation:

2+ yrs.

Cooperation:

2+ yrs.

Implementation Of AI/ML Scoring System in FinTech

NetLS developers managed to reduce the default rate in our client's financial company. Automated underwriting, based on AI/ML and automation technologies, has become an opportunity to simplify, reduce the cost and speed up the process of processing loan applications.

Cooperation:

5+ yrs.

Cooperation:

5+ yrs.

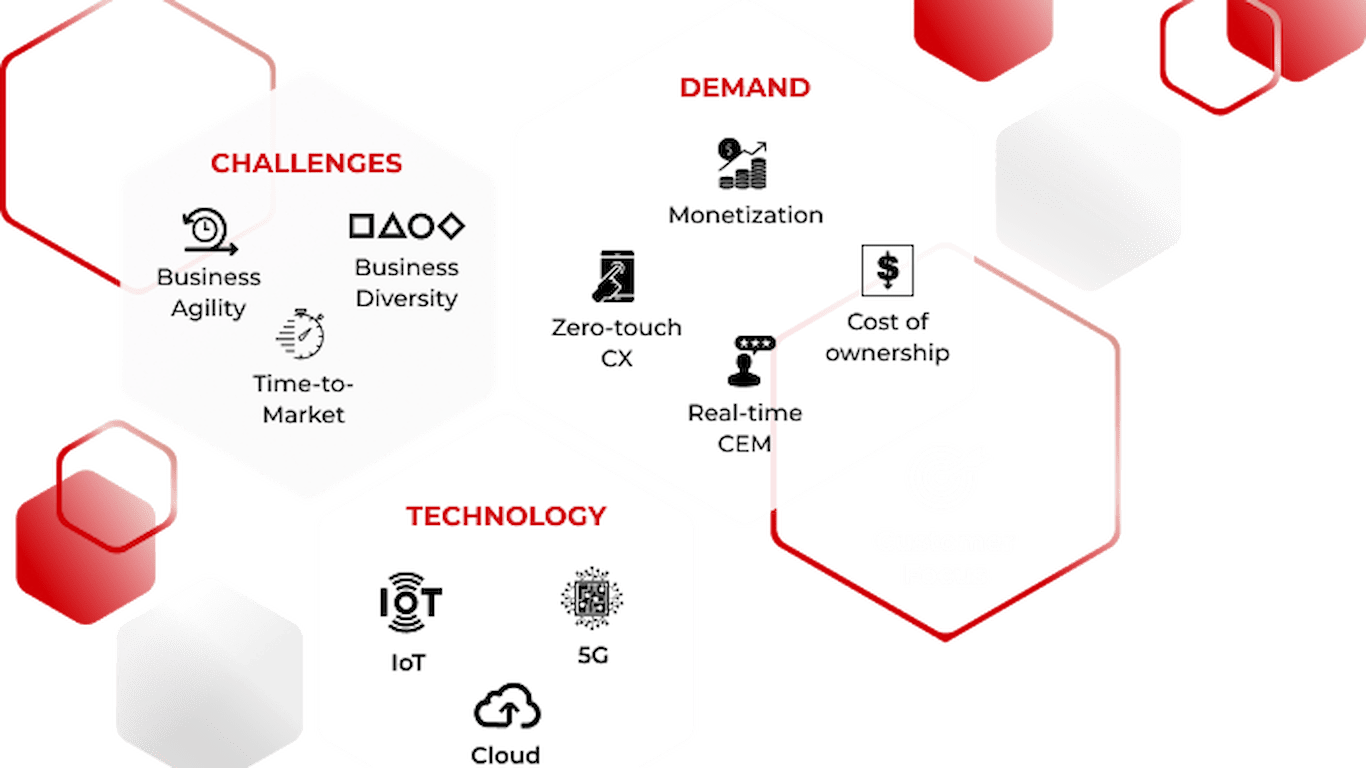

Modern billing solutions, updating the outdated system and entering new markets for NATEC

NATEC develops modern billing solutions for communication service providers. Our team helped to adapt the WideCoup BSS product to the needs of their client, one of the largest mobile operators and Internet providers in Ukraine

Cooperation:

4+ yrs.

Cooperation:

4+ yrs.

Modernization of the OneHSN application in accordance with the latest market research

NetLS modernized the OneHSN kindergarten search application by adding a dark mode and updating the design. The cross-platform solution based on Xamarin ensured compliance with new requirements and improved user experience