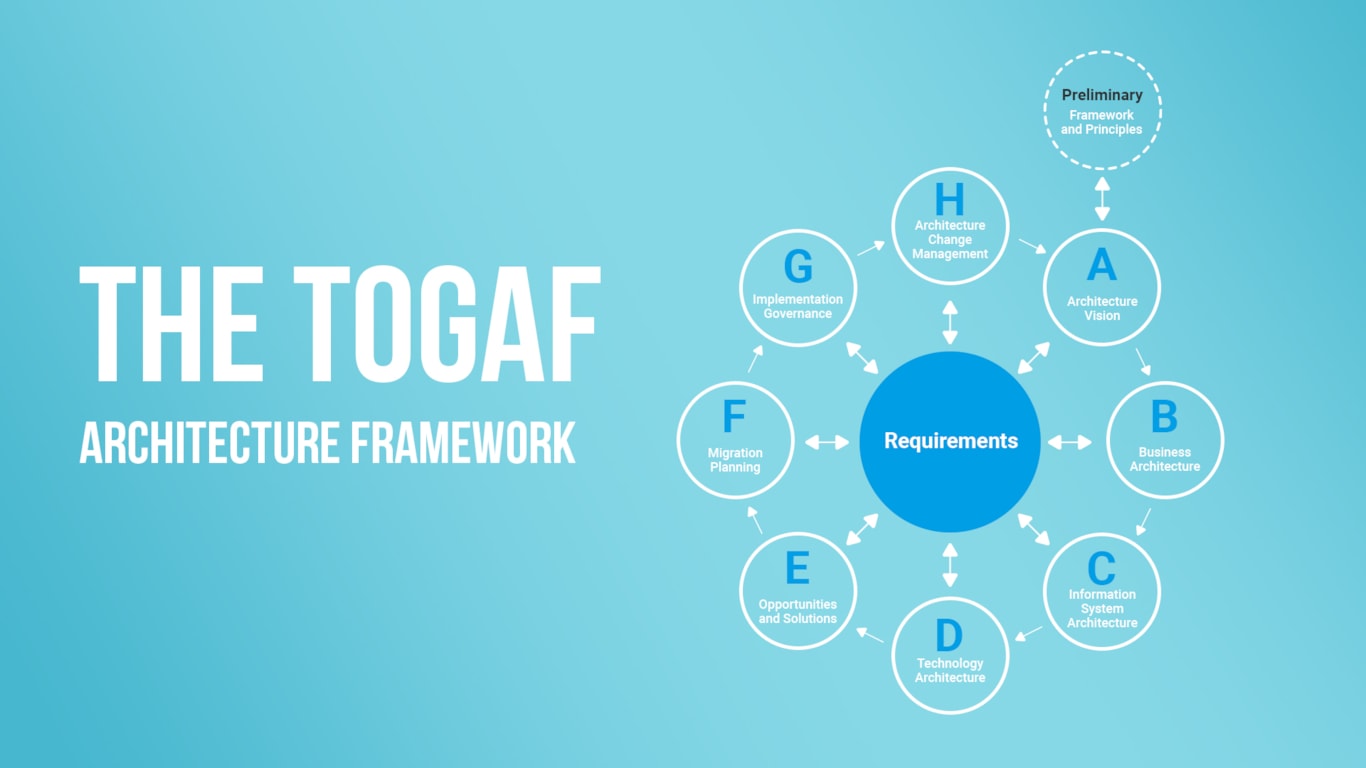

Risk-free enterprise architecture: TOGAF and ArchiMate for strategic growth

For large organizations, it is especially important that business processes are coordinated, structured, and well-integrated with the IT infrastructure. TOGAF and ArchiMate are powerful tools that help professionals streamline all processes and create a forward-looking enterprise architecture.

CI/CD workflows for QC and QA on Google, AWS, and Azure Clouds

Google Cloud, AWS, and Azure are the leading platforms for CI/CD solutions. We’ll compare their capabilities regarding the development and seamless deployment of IT solutions across cloud providers and help organizations explore the best CI/CD tools for automated QC and QA workflows.

Test Plan vs Test Strategy: The simple guide to QA success

Implementing a test strategy and a test plan, essential QA documentation, provides the framework and clarity every business needs to ensure reliable, high-quality software delivery.

Using TOGAF and Archimate: Solving uncoordinated business processes

Uncoordinated business processes are the silent killers of enterprise efficiency. For large organizations, especially those with global operations, the challenge lies in aligning every team, system, and objective. Fortunately, frameworks like TOGAF and tools like ArchiMate offer a powerful path forward.

The process of preparing for enterprise architecture development with TOGAF

Modern businesses can’t afford to run on fragmented systems and outdated IT. To stay competitive, you need a unified architecture that connects strategy, processes, data, and technology. Start designing smarter. Explore how the right frameworks can turn architecture into your strategic advantage.

Why legacy architecture holds back business growth — and how to modernize it without risks

Outdated legacy systems slow innovation, increase costs, and create vendor lock-in risks. Learn how to unlock your business’s full potential with a step-by-step modernization roadmap designed to protect continuity and accelerate growth.

The importance of regulatory compliance integration when entering a new market in Fintech

Fintech thrives on innovation, advancing global financial services with modern technologies. The industry promises a lot of opportunities to ensure seamless payments all around the world. However, despite its immense potential, fintech companies, no matter the size, face a critical challenge: regulatory compliance. In this blog article, we’ll discuss regulatory compliance as a strategic asset for market entry and give tips from industry leaders for cross-border fintech compliance strategy.