Risk-free enterprise architecture: TOGAF and ArchiMate for strategic growth

For large organizations, it is especially important that business processes are coordinated, structured, and well-integrated with the IT infrastructure. TOGAF and ArchiMate are powerful tools that help professionals streamline all processes and create a forward-looking enterprise architecture.

BPMN 2.0: How BPMN standards help build modern architectures

Legacy systems holding you back? Disconnected tools and outdated processes lead to costly errors and slow growth. BPMN 2.0 brings clarity. New version helps align business, teams, and stakeholders through visual process models that drive smarter cloud migration and faster transformation.

Using TOGAF and Archimate: Solving uncoordinated business processes

Uncoordinated business processes are the silent killers of enterprise efficiency. For large organizations, especially those with global operations, the challenge lies in aligning every team, system, and objective. Fortunately, frameworks like TOGAF and tools like ArchiMate offer a powerful path forward.

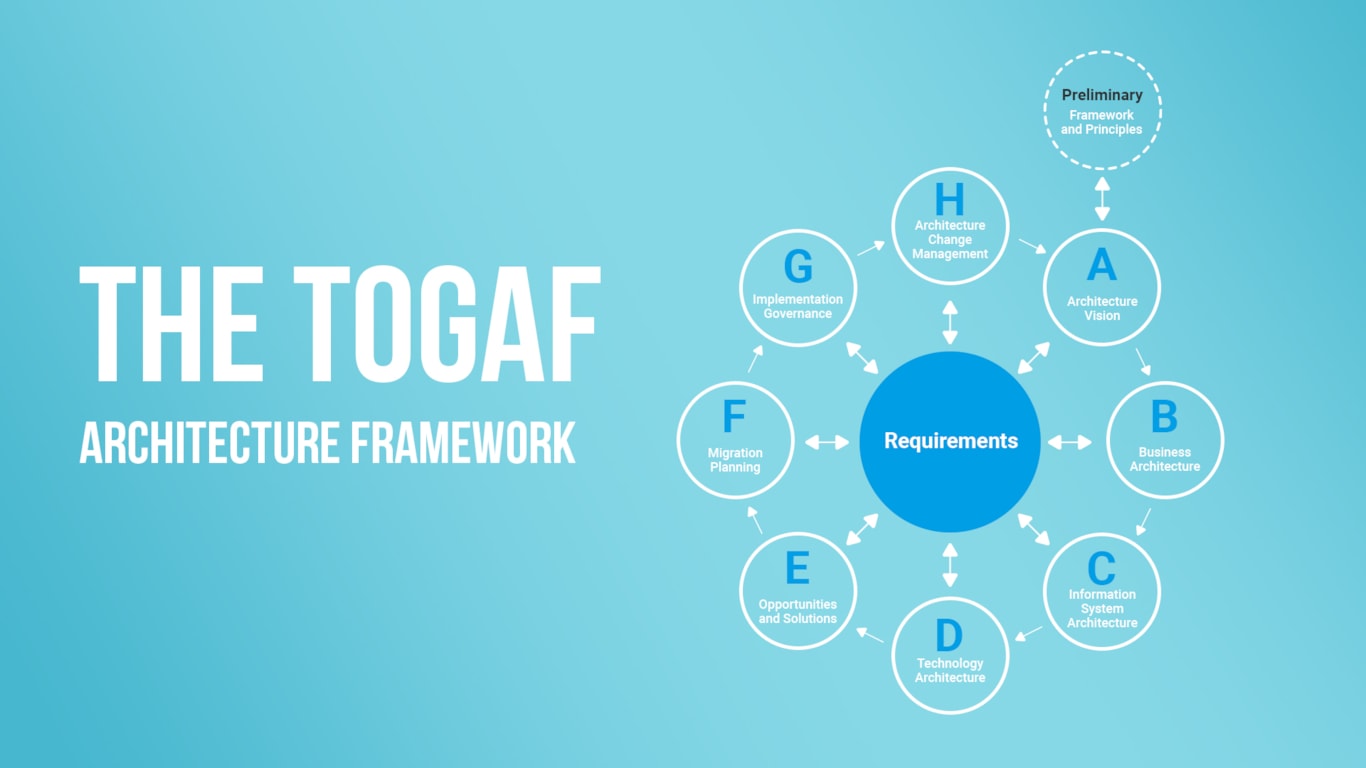

The process of preparing for enterprise architecture development with TOGAF

Modern businesses can’t afford to run on fragmented systems and outdated IT. To stay competitive, you need a unified architecture that connects strategy, processes, data, and technology. Start designing smarter. Explore how the right frameworks can turn architecture into your strategic advantage.

The importance of regulatory compliance integration when entering a new market in Fintech

Fintech thrives on innovation, advancing global financial services with modern technologies. The industry promises a lot of opportunities to ensure seamless payments all around the world. However, despite its immense potential, fintech companies, no matter the size, face a critical challenge: regulatory compliance. In this blog article, we’ll discuss regulatory compliance as a strategic asset for market entry and give tips from industry leaders for cross-border fintech compliance strategy.

Technological trends and modern practices in testing FinTech solutions

The future of financial technologies through the scope of their impact on the present. How innovative technologies in FinTech not only change the industry but also provide key tools to improve the quality and reliability of financial services through innovative approaches to testing

Key Steps of the Digital Finance Consulting Process Flow

Digital finance consulting is the best way to assess a company's financial systems and processes. In this article, we discuss the actions and technologies that digital finance transformation involves.

Applications and Web-Enabled Services Accessibility Compliance: a Modern Norm for the FinTech Institutions

Promoting digital inclusion in the FinTech sector is essential for some and useful for all. Established legal requirements aim to comprehensively address accessibility issues and implement assistive technologies.